Lufthansa has restated its interest in acquiring TAP Portugal during its earnings call for fiscal year 2022. Air France-KLM has also expressed the same last month, as well as the IAG group, owner of British Airways and Iberia, who is monitoring what is happening with the Portuguese airline. According to Bloomberg news, during its earnings call the German company’s it said that the most interesting targets for mergers and acquisitions are the Portuguese TAP and the Italian ITA.

Along with other major European airlines, Lufthansa is forecasting an increase in profits this year. The company expects a significant improvement over the 1.5 billion euros of operating profit it earned in 2022. The company explained that summer vacations in Mediterranean countries and travel on North Atlantic routes will be particularly strong.

“Lufthansa is back,” CEO Carsten Spohr said in a statement, quoted by Bloomberg. “In one just one year we have achieved an unprecedented financial turnaround,” said Spohr. Lufthansa was the latest major European airline to announce profits last year, joining Air France-KLM and British Airways in forecasting a recovery approaching pre-pandemic levels in 2023.

With an operating profit of 1.5 billion euros, the Lufthansa Group has achieved a much better result than expected.

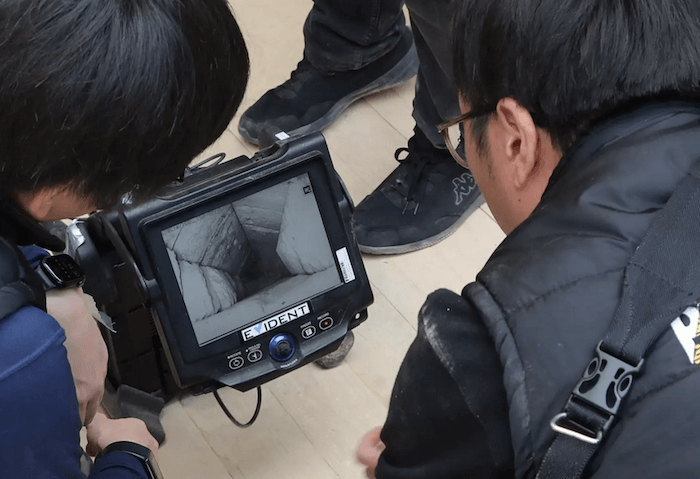

Carsten Spohr, CEO of Deutsche Lufthansa AG

The German carrier also announced it will buy 22 new wide body aircraft from Airbus and Boeing, as reported by Bloomberg. The order, valued at $7.5 billion at list price, aims to meet growing demand for intercontinental travel. The airline also said that preparations for a possible partial divestiture of its Lufthansa Technik division are underway, and that it is still in exclusive negotiations with the Italian authorities over ITA Airways.

On March 3rd, Lufthansa Group released data revealing that it has achieved a financial turnaround in 2022. Lufthansa doubled its revenue from €16.8 billion to €32.8 billion during the 2022 financial year, and its EBIT (Earnings Before Interest and Taxes) jumped from -€1.7 billion to €1.5 billion. The Group expects further significant improvement of adjusted EBIT for 2023.

The increased revenue is due to the strong increase in demand for air travel. During the last year, significantly more passengers flew with the airlines of the Lufthansa Group than in 2021. Passenger numbers more than doubled: The group’s airlines welcomed over 100 million passengers on board.

Following the strong increase in demand for air travel, Lufthansa significantly expanded the number of offered flights over the course of 2022. Passenger airline revenues increased by 148% year-on-year to 22.8 billion euros in the financial year 2022 (previous year: 9.2 billion). Adjusted EBIT at Passenger Airlines improved significantly in the past fiscal year, at an operating loss of -300 million euros (previous year: -3.3 billion euros).

Demand for air tickets is expected to remain strong in the current year, particularly during the Easter and summer vacation periods. The most popular destinations are Spain, Italy, Greece, and other Mediterranean countries. Passenger Airlines will also benefit from high demand for flights to and from North America.

Thanks to this strong demand, capacities for passenger flights will be expanded. Capacity is expected to increase to around 85 to 90% on average compared with 2019.

In the Logistics segment, Lufthansa expects a significant decline in revenue due to the further normalization of the airfreight market. However, freight rates are expected to remain above the pre-crisis level in 2019. This means that the operating result in the Logistics segment will be down compared to 2021, but will remain well above the pre-crisis level. As for Lufthansa Technik, the Group expects 2023 earnings to be at least on a par with the previous year.