The European Bank for Reconstruction and Development (EBRD) is boosting the financial resilience of Kazakhstan Temir Zholy (KTZ or Kazakhstan Railways) by investing up to KZT 50 billion in a local currency bond issue to be listed on the Kazakhstan Stock Exchange (KASE).

The investment is meant to help Kazakhstan’s state-owned railway operator to restructure its balance sheet and implement a range of crisis response measures. This will include the reorganization of its transit freight operations, to cope with the after-effects of the pandemic and ongoing geopolitical turmoil.

By investing in the local bond issue of Kazakhstan Railways, the EBRD is improving the sustainability of a major domestic company.

Huseyin Ozhan, EBRD Head of Kazakhstan

The move is the EBRD’s first ever investment in a local currency bond in Kazakhstan and the first issue of a bond with TONIA-linked coupon by a local company. The tenge overnight index average rate (TONIA) has been developed jointly by the National Bank of Kazakhstan, the EBRD and the country’s leading financial institutions and is used as a benchmark rate for lending instruments. According to Kazakh experts, the European Investment Bank (EIB) ought to see this as an opportunity for investment as well.

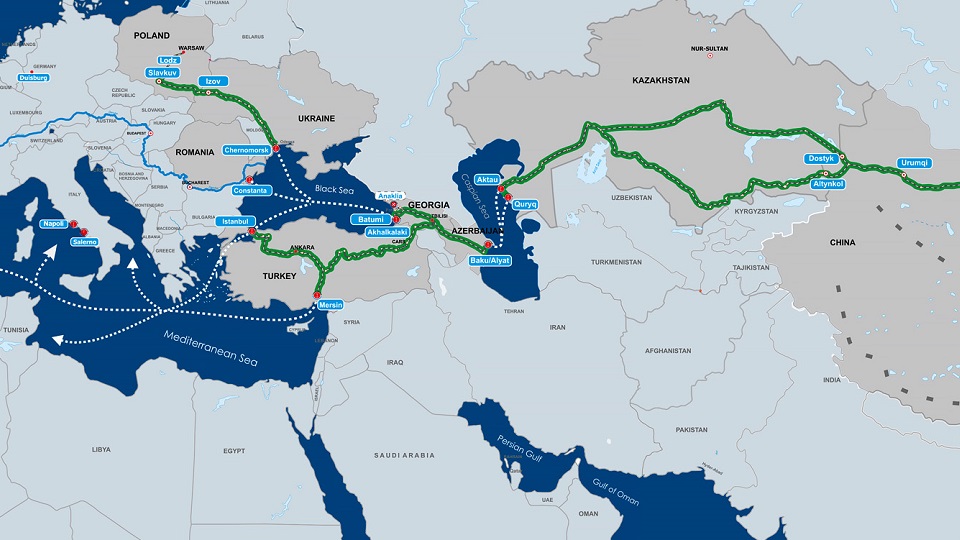

KTZ, which owns and operates a 16,000-kilometre railway network and manages more than 1,720 locomotives and 46,200 freight cars, will use the new capital to modernize key infrastructure along the Middle Corridor for rail container transit.

Until recently, up to 95% of freight traffic between China and the European Union (EU) travelled through the Northern Corridor. As international carriers are increasingly looking for alternatives to the Northern Corridor, demand for transport through the Middle Corridor, which links Kazakhstan to Azerbaijan, Georgia and Turkey through the Caspian Sea, has increased significantly. Its development is of primary importance to the sustainability of regional trade.

The Trans-Caspian International Transport Route (TITR), also known as Middle Corridor, is a multilateral institutional development linking the containerized rail freight transport networks of China and the EU, passing through Central Asia, the Caucasus, Turkey and Eastern Europe. The multilateral, multimodal transport institution links Caspian and Black Sea ferry terminals with rail systems in the Asian and European countries. On March 31st, 2022 the governments of Azerbaijan, Georgia, Kazakhstan and Turkey signed a declaration on improving the transportation potential through the region.

The investment contributes to better regional and international connectivity and trade security, as the Middle Corridor offers one of the few realistic alternatives for China-Europe rail freight transportation

Huseyin Ozhan, EBRD Head of Kazakhstan

Cargo transshipment through Central Asia and the Caucasus will grow six times in 2022 compared to the previous year, to 3.2 million metric tons, according to the estimates of an association composed of the major state transportation companies in the region. “This is due to the sharply increased demand for the route against the backdrop of recent events taking place in the world,” the Trans-Caspian International Transport Route Association (TITR) wrote in a May 10 press release. Russian Railways, which had played a major part in China-Europe cargo transportation, has fallen under American and European sanctions.

It is expected that local investors will frequently use TONIA-linked bonds as an effective hedging tool against inflation. They will also contribute to the development of the local capital market.

In 2022 the EBRD marks 30 years since Kazakhstan joined the Bank. With more than US$ 9.6 billion invested in the country to date, this is the largest and longest-running uninterrupted banking operation of the EBRD in Central Asia.